Recently, photography NFT collections on opensea have been trending. A lot of collectors have woken up to them, with many selling out in hours. These will be collections of usually 20-50 photos all minted into a series, starting with a relatively low start price in ether terms.

When NFTs first got hot in the photography niche in march-april of this year, back then we were mostly focusing on selling single edition nfts for a higher start price, at least relatively. Just as an example, collection prices would start from 0.1-0.3 eth each while usually single editions on foundation or such would start at 0.5-2 eth (and have an auction).

The lower price of collections has expanded the amount of potential buyers. It also psychologically makes collections more appealing, because you can see an entire series on one page, instead of having to jump through several different platforms such as foundation and superrare and makers place to get an idea of what relates to where.

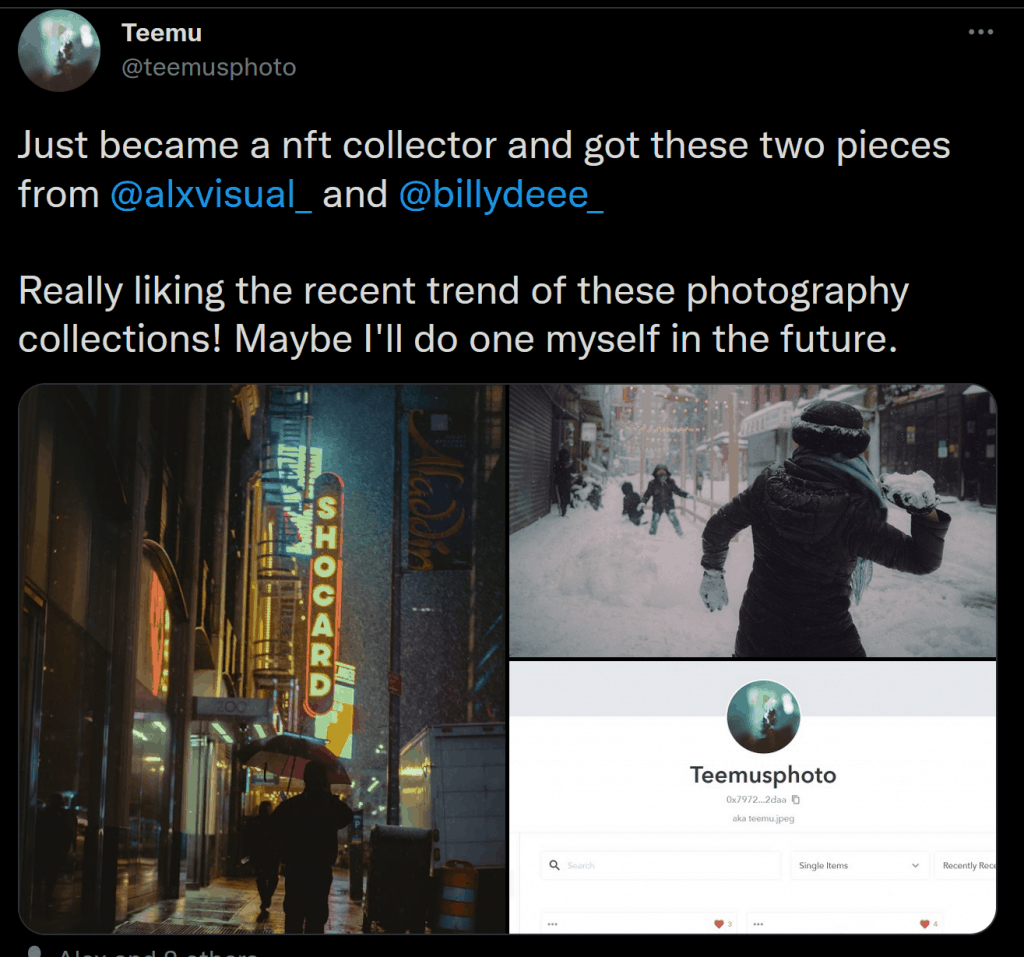

The lower start price and collectibility of these photography collections has made them really blow up in the span of the last few months, so much so that I myself felt inclined to get into collecting and flipping some of them. It is so much easier to be able to get in the game for 0.1-0.3 eth, as opposed to having to spend 1-2 eth.

Furthermore, collections seems to have a better re-sale potential, simply because even after a collection is sold out, the nft creator can keep promoting the entire collection page, where every available nft from that collection will be clearly listed on the same page. This in turn makes collections a much better and clearer investment. It all works together to move this in the right direction.

And the reason creators keep promoting their collections is that they get a 10% cut on each sale, so there is plenty incentive. As well as simply raising the floor price of your pieces – it looks better all around if your new floor price is suddenly up to 3eth and you started at 0.3 – even if nobody is actually spending whatever the floor is.

So in order to keep secondary sales flowing, creators are incentivized to create “collector perks”. These can be anything from physical benefits, such as prints, or bonus nfts, or privileges to buy the next collection at a discount. I myself am planning to create an exclusively available photo book only for my collectors (don’t steal the idea, my legal team is big, trust me, I definitely have many lawyers).

Is there a bubble?

All this may sound like nfts are only being purchased for speculative purposes. If creators get a cut from each potential resale, and collections are structured in a way that makes resales very easy, much easier compared to before – then what is the main driver of this market? Is it the perks? Perhaps, but the primary motivator for a lot of collectors is the ability to flip the art later for a higher price, so there is an obvious speculative bubble going on here. I don’t think many would deny that. But hold on, let’s talk about bubbles.

Just because a bubble exists, doesn’t mean it’s going to pop anytime soon. The entire world financial system is dependent on a debt bubble. The stock market is a massive speculative bubble. Pokemon cards are a bubble. Not to mention traditional art. Just because we see a bit of a bubble, doesn’t automatically make this a bad investment. The difference is, how soon will it burst and what is the longevity of this market.

I already talked about “value” and the potential longevity of nfts on a previous video half a year ago, and I think these thoughts have held up relatively well:

Flipping NFTs

Just as an experiment, I recently decided to invest in my friend’s nft collections. I bought 3 nfts, spending 0.7 eth in total. So far, 2/3 have resold while one of them is still waiting for a buyer. I played things pretty safe with my first two flips, earning 0.2 and 1.7 eth in profits per flip. I could have probably got a bit more had I been more patient, but I’d never resold anything so this was mainly an experiment.

So despite me only having done 3 attempted flips with a (so far) 66% success rate and a nice ROI, I could already gather a couple of obvious lessons on what to invest in. I’ll share some not-financial advise next.

The nfts that resold were from creators that were highly motivated to participate in the community, to offer perks for holders, and had a great body of work.

They both had their own discord servers for collectors. They both heavily participated in the space. And I got in early in both cases. The only thing I had to see was the motivation behind them, to know they’d continue to heavily promote and participate, to know this was a good investment. I knew they weren’t in it just for a quick cash grab.

Promoting NFTs is a fulltime job

Selling NFTs is not traditional type of marketing, at least for the most part. It’s more like very personalized social networking with a couple of basic marketing principles thrown in the mix. You have to participate in Clubhouse I mean Twitter Spaces, Discord channels, and Twitter. You know how if you want to be famous on Instagram one way to do it is to comment “Fire” on your friends posts 75 times per day? NFT marketing is that, times a hundred, at least if you wanna be cynical. If you make a name for yourself as a big spender on NFTs, or even just invest in a couple to be honest, the amount of phony ass kissing you’ll receive in your mentions and inbox is going to be ridiculous, which very quickly exposes the transparent motivations of so many people.

There is a strong sense of community in the NFT niche, and some of it is genuine. It’s great to see lives changed, it’s great to see people embrace this field and gain an ability to make a living out of their art only. But there’s also people who go too far, and some aspects of this niche just feel like a complete circle jerk motivated by greed. Whenever money is involved, that is of course natural, especially because NFT money has the potential to be life-changing for many people. Especially if the crypto market as a whole keeps trucking.

Don’t get me wrong, I am in no way opposed to GOOD marketing or capitalism or even speculative investment – again, I’ve profited from this myself on both sides of the aisle. But what I do find a little bit repulsive is when people completely sell their souls to make this work. If I can tell just from the sidelines, collectors who are bombarded with messages daily can DEFINITELY tell when someone is being fake.

So my takeaway from this is that authenticity is still very valuable in my eyes – be careful not to go over that line, don’t sell your soul too much. Or, if you’re gonna sell your soul, do it tastefully. I’m not going to fault people for going for such big amount of money, I guess I just wish people were a bit more subtle about it. If I haven’t heard of you for 2 years, then suddenly I see a tweet or message praising me and it’s 2 hours after you’ve just announced your own collection, that’s a little bit too on the nose. Again, I’m not opposed to lifting each other up, but when it’s completely fake, I have no tolerance for it. I’m not going to call out anyone in particular, because I don’t have to – if you follow the space for even just a couple of days, you’ll be able to see many examples of this yourself.

To sum it up though, from the beginning I’ve loved the idea of tying real world benefits into NFTs. I’d say in light with recent developments, they can be virtual benefits too, let’s just call them “perks”. That gives NFTs a much more lasting chance of booming well into the future, even after people who were in it just for the quick cash grab lose interest. Perks, if substantial, also at least theoretically make more traditional marketing possible, meaning that you might be able to make a living without participating in the circlejerk as much.

These are just my current thoughts, it’s a very dynamic market. It’s a very dynamic world really. Who knows how it’ll look in 3-6 months time, let alone in a year. I’ll be following the space with an interest. I don’t actually feel very strongly either way, so don’t read too much into my opinions, I reserve the right to change them in case they turn out to be totally wrong!